Tips for Smart Investing

It's a simple truth: Investing is generally better than not investing.

While it's natural to want to wait until market conditions are "right," that's a call even professional investment managers find tough to make. A better strategy is to just get started.

Don't delay

Research shows that on average, even investors with bad timing earned twice as much as people who held their savings in cash-like investments over a 20-year period. And those who stick to their investment plan achieve a higher net worth than those who don't.1 There isn't a magic formula—reaching your financial goals takes time, discipline and a good investing strategy. Here's how you can get started.

Starting earlier rather than later allows you to benefit longer from compounding returns. But data also show that staying the course and continuing to invest regardless of market conditions can lead to greater wealth accumulation.

Whether you're just starting to invest or considering making changes to your existing plan, remember: Showing up is half the battle. Even if you don't invest in all the right things at the right time—who does?—you'll generally be more successful on the field than on the sidelines.

-

Chart shows average ending wealth in each 20-year period from 1926–2016. Treasury bills were used for the cash investment example. In examples where waiting to invest was a factor, the yearly $2,000 investments were placed in Treasury bills while waiting to invest in stocks. Stocks are represented by the S&P 500® Index, with all dividends invested. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Fees and expenses would lower returns. This chart represents a hypothetical investment and is for illustrative purposes only. The actual annual rate of return will fluctuate with market conditions. Hypothetical performance is no guarantee of future results. Source: Schwab Center for Financial Research.

Videos

-

Watch video: It's important to just get started

In this video, watch one woman's journey of starting a new business and beginning to invest. -

Watch video: How do you take the leap?

Temi is an entrepreneur who recently took the leap into investing. Watch her story.

Understand asset allocation

So you've decided to start investing. Next question: What's your goal? Is it to build up a retirement fund over several decades? Save for a down payment on a house in a few years? Once you know what your goal is, you can think about the best way to get there. Your path will be guided not only by how much you invest, but how you invest it—in other words, your asset allocation.

Asset allocation is simply the practice of distributing your money among different asset categories such as stocks, bonds, cash and commodities to balance risk and reward and get you closer to your financial goals. Generally speaking, a person who has a long time to save and who's willing to weather the ups and downs of the stock market has a high tolerance for risk and could see that rewarded with greater performance (or punished with greater losses). A person who doesn't have much time to save and doesn't have a lot of stomach for risk could see smaller potential gains, but also smaller potential losses. Bottom line: These two people should have different asset allocations because they have different goals, time horizons, and risk tolerances.

Very few investors have been successful in timing the market. So instead of worrying about that, consider thinking more about asset allocation. Research has shown that it's one of the most important investing decisions you can make. The graphic below shows how changing the mix of assets you're invested in can have a dramatic effect on performance—and on your exposure to risk.

Asset allocation has evolved

Today, investors have access to more niche asset classes, so a moderate portfolio can look more like this.

-

For illustrative purposes only. Not representative of any specific investment or account. For further information see: "Indexes used for Charts 2 and 3" in the Disclosures section.

What is your risk tolerance?

Use the slider to select a level of risk. Then see how a hypothetical portfolio with that risk level performed each year over a 30-year period in the graph.

-

For illustrative purposes only. Not representative of any specific investment or account.

Annualized returns are calculated using data from 1989 through 2019 and include reinvestment of dividends, interest, and capital gains. Stocks are represented by the S&P 500 Index, bonds by Barclays U.S. Aggregate Bond Index and cash by the IA SBBI U.S. 30-Day Treasury Bill Index. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested directly. Past performance is not a guarantee of future results.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice.

Diversify your portfolio

The beauty of diversification is that it can help you manage the optimal mix/balance of risk and return.

The three traditional primary asset classes—stocks, bonds and cash—tend to fare differently in various market environments. For instance, stocks often perform well when economic growth is strong, while bonds may outperform when growth slows. By investing in all three of the basic asset classes—as well as commodities and possibly other investments—you're diversifying. This helps you minimize your reliance on any one area of the market and can help maximize the possibility that you'll own assets that appreciate in value.

And diversification can go even further than that. Most investors can remember periods when U.S. stocks performed better than international stocks, when blue chips did better than high—growth stocks or when technology companies outperformed health care companies. By investing in different asset classes, you can reduce your exposure to any one particular region or industry.

Finding the right balance can be challenging, but there's help out there. An investment adviser can help you allocate your investment appropriately, based on your risk tolerance and investment time horizon. There are resources online that can help, as well. And if you'd rather let someone else do most of the driving, consider investing through an automated investment advisory service, such as Schwab Intelligent Portfolios®.

Why diversify?

Because markets are unpredictable. For example, Emerging Markets Stocks was the top performing asset class in 2009 with a 78% annual return.

See if you can choose the top-performing asset classes from 2014 to 2019. Click your top pick for 2014 to get started.

-

Asset class performance is represented by annual total returns and assumes reinvestment of dividends, interest and capital gains. See disclosures at the bottom of the page for more information about the market indexes used. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

Source: Schwab Center for Financial Research.

Rebalance periodically

You've figured out the best asset allocation for your risk tolerance, so you can turn on autopilot, right? Not exactly.

Even if you do nothing to your portfolio, the markets will eventually change it for you. That's because some of your investments will perform better than others, taking up more room in your portfolio over time—while investments that haven't done as well will take up less room. This can cause your portfolio to drift away from its target asset allocation. When that happens, it may no longer reflect your risk tolerance. You may be taking on more or less risk than you're comfortable with.

Buying or selling investments in order to restore your portfolio back to its target asset allocation is called "rebalancing." Let's say you want stocks to make up half of your portfolio, but after a recent market rally, they've risen to 70%. To restore your target mix, you may need to sell some stocks and/or buy more of something else, such as bonds.

Sounds easy, right? It can be. But it can get tricky if you layer in other factors. For instance, how often should you rebalance? Which securities should you sell, and which should you buy? Ideally, you want to keep an appropriate mix of domestic versus international stocks, short-term versus long-term bonds, etc. Tax implications and transaction costs should be considered, as well.

Rebalancing can be challenging for an individual investor to manage manually. If this isn't something you're up for, a sophisticated service, like Schwab Intelligent Portfolios, will do this work for you when your asset allocation strays too far from predetermined percentages.

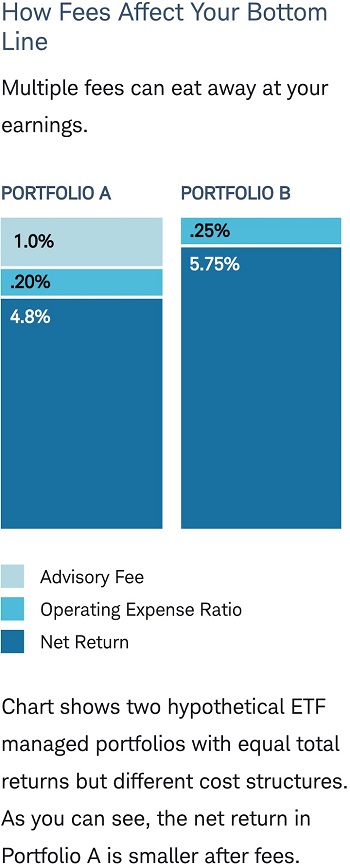

Keep an eye on fees

Markets rise and fall, and economic cycles are unpredictable. However, there's one thing that's certain: fees.

Most fees fall into four main categories: commissions, fund fees, advisory fees and account fees. If you trade individual stocks or exchange-traded funds (ETFs), you will likely be charged commissions each time you buy or sell securities. If you invest in a mutual fund or ETF, you'll pay an operating expense or a recurring annual fee to cover the fund's management, trading and operational expenses. If you go the managed route, most advisors charge a fee to build and oversee your portfolio, which can either be a fixed amount or a percentage of your total assets. Additional fees may be assessed for redemptions, wire transfers, failure to maintain a minimum balance or other reasons.

The question is: How much are you paying? Fees can vary widely within each category—for instance, actively managed funds typically charge more than passive index-tracking funds, simply because of the greater work involved. Funds that invest in smaller, more niche and global investments may charge more for the same reason. As long as you're comparing apples to apples, it's worth shopping around to make sure you're not paying excessively high fees for the same market exposure and performance potential.

Look at it this way: While fees may appear small at the outset, even 1.2% in fees can reduce your earnings significantly over time. For example, let's say you have $100,000 invested in each of two diversified portfolios: Portfolio A charges 1.2% in fees and Portfolio B charges 0.25% in fees. Assuming a 6% annual rate of return over a 30-year period, Portfolio B would earn about $130,000 more than Portfolio A.

-

For illustrative purposes only. Portfolios A and B assume a 6% annual rate of return over a 30-year period. Portfolio A assumes a 1% advisory fee and a .20% operating expense ratio charged annually. Portfolio B assumes only a .25% operating expense ratio charged annually. Hypothetical performance is no guarantee of future results. The impact of fees on a portfolio can have equal impact during a negative performance period. The chart does not reflect all fees that may be charged and is not representative of any actual investment, product, or fee structure.

The impact of fees

Fees are common when investing, but it's important to keep an eye on how high they get. Excessive fees can stunt a portfolio's growth—costing you thousands of dollars over time. Use the sliders below to see the effect fees can have on a $100,000 ETF portfolio over a 40-year time span. The bottom line: Paying attention to fees not only helps to minimize costs, but also keeps more of your money invested in the market and working for you.

For illustrative purposes only. These projections assume a 6% rate of return, are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Fees will impact your portfolio even during periods of negative market performance. The chart does not reflect all fees that may be charged and is not representative of any actual investment, product, or fee structure.

Consider tax-loss harvesting

Losses are never pleasant, but there can be a silver lining: tax savings through tax-loss harvesting.

When you sell a security for more than you originally paid for it, the profit is a "capital gain." It's taxable if it occurs in a taxable account—not a 401(k) or IRA, for instance, which are tax-deferred accounts.

In the 2018 tax year, short-term capital gains (those on investments held for a year or less) will be taxed at your ordinary income tax rate, while long-term capital gains, or investments held for longer than a year, are taxed at either 15% or 20%, depending on your income level.

A security sold for less than you paid for it generates a "capital loss." If this occurs in a taxable account, you can use the loss on your tax return to offset realized capital gains, by deferring current tax liabilities. In addition, you can offset up to $3,000 in ordinary income to the extent total losses exceed total gains. If there are still losses left after all that, they can be used to offset gains and income in future tax years. To learn more about how tax-loss harvesting works, including the potential pitfalls surrounding the wash sale rule, which disallows losses if you repurchase the same or a substantially identical security within 30 days, click here.

How tax-loss harvesting works

-

1. Your investment loses value.

-

2. You can sell the investment at a loss,

-

3. And buy a similar (but not substantially identical) security to maintain asset allocation.

-

4. This allows you to offset gains of other profitable investments you sold that year,

-

5. And use any additional losses to lower up to $3,000 of ordinary income.

Simplify your investing

Investing can be time consuming and complex. Technology is helping to simplify it.

For some, acting on the above principles is a welcome challenge, but if you're busy or don't enjoy managing money, you might let things slide. Simplifying your investing can render the process less daunting and make it easier to stay engaged.

For example, if you hold multiple accounts at various financial services companies, it can be tough to get a clear picture of your total portfolio. This can keep you from taking advantage of tax-efficient investing strategies or effective retirement income planning. Combining accounts with the same objective could make it easier to keep track of your investments.

Setting up automatic contributions into your investment accounts also can make it easier to stick to your plan. In addition, making fixed regular purchases over a long period of time—a strategy known as "dollar cost averaging"—means you can buy more shares when prices are down, and fewer shares when prices are up.

Want to simplify your investing even more? Let an automated investment advisory service like Schwab Intelligent Portfolios do the work for you. This service combines a sophisticated algorithm with a dedicated team of experienced analysts to produce diversified ETF portfolios that can help investors pursue their financial goals.

-

Periodic investment plans like dollar cost averaging do not ensure a profit and do not protect against losses in declining markets.

Key takeaways

-

1. Don't delay

Schwab Intelligent Portfolios makes it easy to get started. Simply answer 12 questions about your goals and risk tolerance.

-

2. Asset allocation

Schwab Intelligent Portfolios can help you figure out the right assets to align with your investing goals.

-

3. Diversify your portfolio

Get a diversified ETF portfolio—across up to 20 asset classes—that's appropriate for your stated goals, risk profile and time horizon.

-

4. Rebalance periodically

When your asset allocation strays outside its target range, Schwab Intelligent Portfolios will rebalance to get you back within range.

-

5. Keep an eye on fees

At Schwab we are committed to keeping fees low to help you achieve your goals.

-

6. Consider taking advantage of losses

The service, available for accounts with $50K or more, helps you take advantage of potential tax savings if an investment declines in value.